Comments and suggestions. Interest including late payment interest paid on the loan or mortgage taken to purchase the property that is.

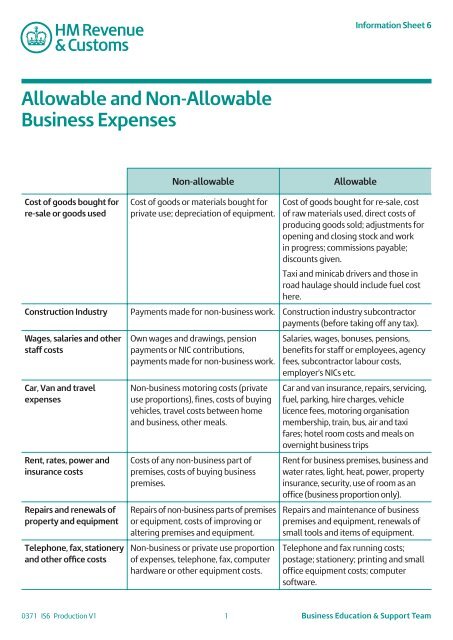

Allowable And Non Allowable Business Expenses

E States Subject to AB 1887s Travel Prohibition.

. There are 5 categories that we place self-education or study expenses in to. You may also be able to claim a deduction for other expenses you incur that dont relate to your work or income producing activities. TEM Roles and Responsibilities updated.

If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid that year for medical and dental care for yourself your spouse and your dependentsYou may deduct only the amount of your total medical expenses that exceed 75 of your adjusted gross income. You can either list the medical expenses for you your. Deductibility of self-education expenses incurred by an employee or a person in business.

Those eligible to apply for grant funding include state agencies state universities non-profit organizations units of local government cities towns and counties. Any of the other parties to the loan -- like the lender or a real estate agent -- can cover these expenses. A Expenses on medical treatment - exempt to the extent permitted by RBI.

Example Your turnover is 40000 and you claim 10000 in allowable expenses. Department of Education Office of Special Education Programs OSEP IDEA General Supervision Enhancement Grant Contract H84326 X020020. Private property owners are not eligible for state grant funding from the Department of States Division of Historical Resources.

For each expense subtract the amount in column 2 from the corresponding amount in column 1. Travel expenses reimbursed after 120 days will be recorded as taxable to the employee. Nneka and Sergio will each multiply their allowable expenses by 6 to determine their employment-use amount.

The following states are currently subject to Californias ban on state-funded and state-sponsored. One consumer unit spends an average of 5102 every month in 2018That implies that the average budget for an American is 61224 and is a 19 increase from the previous year. Submitting Visa and Legal Permanent Resident Fees in TEM updated.

NW IR-6526 Washington DC 20224. Enter the result in column 3B 3C andor 3D of Chart 1 as applicable. Installation of fixed assets.

Code 111398 subd. Canada Revenue Agency CRA has compiled a list on its website of allowable deductible expenses. Impairment loss on non-trade debts.

B Expenses on stay abroad for patient and one attendant - exempt to the extent permitted by RBI. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Legal and professional fees incurred relating to non-trade or capital transactions.

Last lets take a look at some costs and fees that are truly non-allowable meaning VA buyers cant pay them regardless of whether the lender is charging the flat 1 percent fee. Consumer units according to the BLS include families a single individual living alone or sharing a home with others but who dont depend on another financially or two more persons. The table below lists allowable and non-allowable rental expenses.

As a complement to the list below please review the Summary of Unallowable Travel Expenses. Interest expenses relating to non-income producing assets. If all of your self-education or study expenses are from category A then you have to.

We welcome your comments about this publication and suggestions for future editions. You claim these in your tax return at the specific expense category where available or as an Other deduction. Generally an allowance is non-taxable when it is based solely on a reasonable per-kilometre rate.

The law also requires the Attorney General to develop maintain and post on his Internet Web site a current list of states that are subject to the travel ban. 4 Terms of the contract. Claim the corresponding provincial or territorial non-refundable tax credit on.

Medical expenses amount exceeding 1 of total remuneration. You did not receive a non-taxable allowance for motor vehicle expenses. Travel Card T-Card The University of Illinois T-Card is a charge card that may be used by U of I System employees to purchase qualified travel expenses business meals and catering.

Flexibility in Figuring Out Whats Deductible. A A cost is allowable only when the cost complies with all of the following requirements. Common claims at this section include expenses such as.

Contractors subcontractors and construction workers work full time seasonally or often have side jobsTo ensure you pay the correct amount of taxes keep track of your ordinary and necessary expenses for each of your jobs should the IRS ask for documentation. Allowable Expenses and Activities The ARPA grants program is intended to help communities respond directly and immediately to the pandemic as well as to related economic and community needs through equitable approaches. Departments have the discretion to refuse to reimburse expenses submitted more than 60 days after the expense was incurred.

Or territorial Form 428. Cost of managing tax affairs. Singapore income tax and any tax on income in country outside Singapore.

An ordinary expense is a common cost or. Water rates council tax gas and electricity. 5 Any limitations set forth in this subpart.

Please contact Jordan Tietz at 515-294. You can deduct some of these costs to work out your taxable profit as long as theyre allowable expenses. Enter these amounts in the Calculation of Allowable Motor Vehicle Expenses area on Form T777 Statement of Employment Expenses and attach it to your paper return.

You will find a list of non-eligible expenses. 3 Standards promulgated by the CAS Board if applicable otherwise generally accepted accounting principles and practices appropriate to the circumstances. For more detail about the deductibility of self-education expenses see TR 989 Income tax.

When it comes to closing costs. Salaries and benefits for temporary staff or additional hours for existing non full-time staff to be employed for the. C Cost on travel of the employee or any family or one attendant - exempt if Gross Total Income before including the travel expenditure of the employee does not exceed Rs.

250 reduction in expenses. Initially this web site was developed with funding from the US. Some examples of allowable expenses you can claim are.

The list is not exhaustive and includes items such as.

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Chapter 5 Corporate Tax Stds 2

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Updated Guide On Donations And Gifts Tax Deductions

Busine St Partners Plt Chartered Accountants Malaysia Facebook

Impairment Related Work Expenses Ticket To Work Social Security

Pdf Allowable And Disallowable Expenses Allowable Expenditure Disallowable Expenditure Sharifu Ngapawa Academia Edu

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

The Lesser Known Art Of Calculating Irs Allowable Living Expenses

Form 2106 Employee Business Expenses Definition

Expenses Definition Types And Practical Examples

Pdf Deductible And Non Deductible Expenses

General Expenditures Examples Of Allowable And Unallowable Costs Child Nutrition Nysed

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How To Reimburse Expenses Tide Business

What To Include In Your Business Expense Policy Sentrichr

What To Include In Your Business Expense Policy Sentrichr

- upu online semakan keputusan

- puma mid valley malaysia

- No Keywords

- plan rumah 3 bilik 1 bilik air

- gambar dinding 3 dimensi

- rumah persekutuan tasik kenyir

- tembok kamar tamu

- kata kata untuk bisa balikan sama mantan

- anwar ibrahim date of birth

- ayat-ayat cinta full movie

- water quality standard malaysia

- warna cat tembok luar rumah yang sejuk

- baby shima roadblock hatiku

- lelaki kiriman tuhan episod 18

- setia impian kajang for sale

- desain rumah mungil asri

- nasi kandar zaman dulu

- soalan bahasa melayu tingkatan 2 2017

- sejarah singkat bola basket internasional

- undefined